top of page

Search

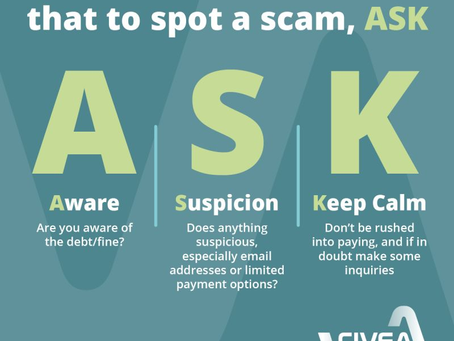

The rise in scam Bailiffs, and how to spot these fraudsters

The rise of ‘scam bailiffs’ - fraudulent individuals posing as Enforcement Agents, has been a major topic in the press

Dukes

Feb 253 min read

69 views

0 comments

Strategies For Managing Money Anxiety and Improving Your Finances

Money anxiety is a common experience for many people, and it can have a significant impact on their mental health. This is especially...

Dukes Bailiffs Limited

Apr 24, 20232 min read

14 views

0 comments

Prepare for your Council Tax bill

Local Authorities up and down the country are preparing domestic properties’ new bills for the upcoming financial year. Your new...

Dukes Bailiffs Limited

Mar 14, 20231 min read

105 views

0 comments

We now offer Open Banking

We are pleased to announce that we now offer Open Banking as a payment method to our customers. What is Open Banking? Open banking is the...

ihamblin-boone

Aug 24, 20221 min read

244 views

0 comments

We've partnered with StepChange for Debt Awareness Week 2022

Debt Awareness Week aims to increase awareness of problem debt, and the advice and solutions available to help. By bringing our money proble

Dukes

Mar 18, 20223 min read

46 views

1. Face up to the facts

The first step towards a debt-free future is to admit that you have a problem. Don’t bury your head in the sand.

Dukes

Mar 3, 20201 min read

17 views

0 comments

2. Get organised; list your income and expenses

Start by looking through your recent bank statements and making two columns: one for incomes, and one for outgoings, this will help you see

Dukes

Mar 3, 20201 min read

31 views

3 comments

3. Prioritise your debt

Assess which outgoings are completely necessary. Your debts should of course come first, followed by any bills, direct debits...

Dukes

Mar 3, 20201 min read

21 views

1 comment

4. Make cutbacks to reduce your expenses

Now that you’re starting to make your way out of debt, it’s time to make sure you stay out. Start by cutting down on what you don’t really n

Dukes

Mar 3, 20201 min read

12 views

0 comments

5. Shop around for savings

Use comparison sites to make sure that you're on the right mobile tariff, and aren't paying too much on your energy bills.

Dukes

Mar 3, 20201 min read

7 views

0 comments

6. Boost your income

After you’ve cut all you can, it’s time to start boosting your income. There are plenty of ways to boost your income

Dukes

Mar 3, 20201 min read

20 views

0 comments

7. Never borrow more money to pay off debts

Although quick fixes like payday loans may seem like easy money, they often come with phenomenally high rates of interest and numerous other

Dukes

Mar 3, 20201 min read

20 views

0 comments

Introduce 'No-Spend' Days

On the quieter days of the week - Monday and Thursday being the obvious examples, keep any cash or credit cards firmly in your wallet.

Dukes

Feb 11, 20201 min read

70 views

1 comment

Think of your Credit Card as a 'Debt' Card

The clue is in the name when it comes to the biggest problem with credit cards; as soon as you start using one, you're in debt not credit.

Dukes

Feb 11, 20201 min read

18 views

0 comments

Leave Your Credit Cards at Home

It can often be difficult to stick to your budget when you have a credit card or debit card in your wallet. Avoid overspending...

Dukes

Feb 11, 20201 min read

41 views

0 comments

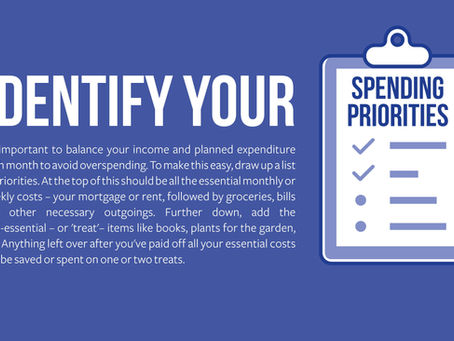

Identify Your Spending Priorities

It's important to balance your income and planned expenditure each month to avoid overspending.

Dukes

Feb 11, 20201 min read

25 views

1 comment

Check your Insurance Policies

If you're a responsible adult who takes the occasional holiday, chances are you'll have an insurance or two - from health and home, to trave

Dukes

Feb 11, 20201 min read

8 views

0 comments

Keep Track of all Your Expenses

Write all of your monthly spends down in a fit-for purpose spreadsheet. It's the small purchases that really count here. You might think tha

Dukes

Jan 22, 20201 min read

46 views

0 comments

Shop Around for Utilities

To find out if you're getting the best deal, use an online price comparison tool. Once you've secured the most cost-effective deal, make sur

Dukes

Jan 22, 20201 min read

6 views

0 comments

Reduce your Overdraft

Overdrafts come in handy but if you don't need such a 'generous' overdraft, ask your bank to reduce it, or get rid of it completely.

Dukes

Jan 22, 20201 min read

15 views

0 comments

bottom of page